The growth of biological products in agriculture

Written byThomas Williams, Director of Microbiology, BioConsortia, USA andHolly Meadows-Smith, Independent specialist in biological and sustainable agriculture technology, USA

Agricultural production must double by 2050, at which time the global population will have reached 9 bn. We will still be battling climate volatility and we will still need to address the environmental impact of farming. Biologicals are central to this discussion.

By offering alternative biological solutions to growers, the agricultural industry will be able to maintain adequate food production levels while reducing the environmental impact. The stigma that biologicals are not as effective as synthetic agro chemicals is slowly being dismantled as the industry sees ever growing investment into the space and more and more growers are seeing results.

Microbials are one biological solution that have held a spot in the industry’s limelight for many years now. More recently, this interest has expanded out into the public domain due to a wider conversation around climate change and an urgent need for answers. Media attention on the potential benefits to be found in the trillions of organisms living in the soil has been helpful in spurring further research into identifying agriculturally useful microbes.

Microbials are a solution that have held a spot in the industry’s limelight

Thanks to this earlier burst of interest in microbial effects on human nutrition, the public was primed to understand the extrapolation into plant health. The benefits of the microbiome work in similar ways in both humans and plants – aiding in digestion of nutrients, affecting expression of certain traits and manipulating metabolite expression. Additionally, as research of the human microbiome advanced, so did the accompanying technologies. Microbiome analysis, metagenomics and transcriptomics used to study gut bacteria all play a part in agricultural microbial research. Since 2005, the cost of genome sequencing has decreased a thousand-fold. Fifteen years ago the cost of sequencing a human genome was in the tens of thousands of dollars. Now? Less than USD500. A typical bacterial genome is more than 500 times smaller than the human genome, making these technology advancements all the more beneficial to bacterial microbiology. Scientists are easily able to sequence whole genomes of individual bacteria, as well as look more broadly at the make-up of microbial communities found around plants and in the soil.

Macro drivers

Within the agricultural industry, more stringent regulatory pressures on synthetic pesticides and increases in fertilizer costs are also contributing to the positive momentum behind biological solutions. It is impossible to ignore the negative bearing of pesticide residue and fertilizer run- off on the environment. Regulatory agencies have taken a strong stance and continue to limit the use of certain chemicals. One functional effect of microbes that benefits plants is the ability to breakdown soil nutrients. Nitrogen-fixing bacteria and phosphate solubilizers are able to increase the fertilizer use efficiency of a crop, reducing the necessary application rate of the chemicals without losing yields.

Growers really need to have access to novel tools to meet the challenges

While traditional chemistries become more and more restricted, yields must be maintained in increasingly volatile climates. Droughts, floods and unusually cold or warm spring plantings are plaguing growers in areas which historically have not suffered these problems with such frequency. Consequently, there is a need for more innovative solutions. Arable land is limited globally, so growers really need to have access to novel tools to meet the growing challenges they are facing.

Research costs

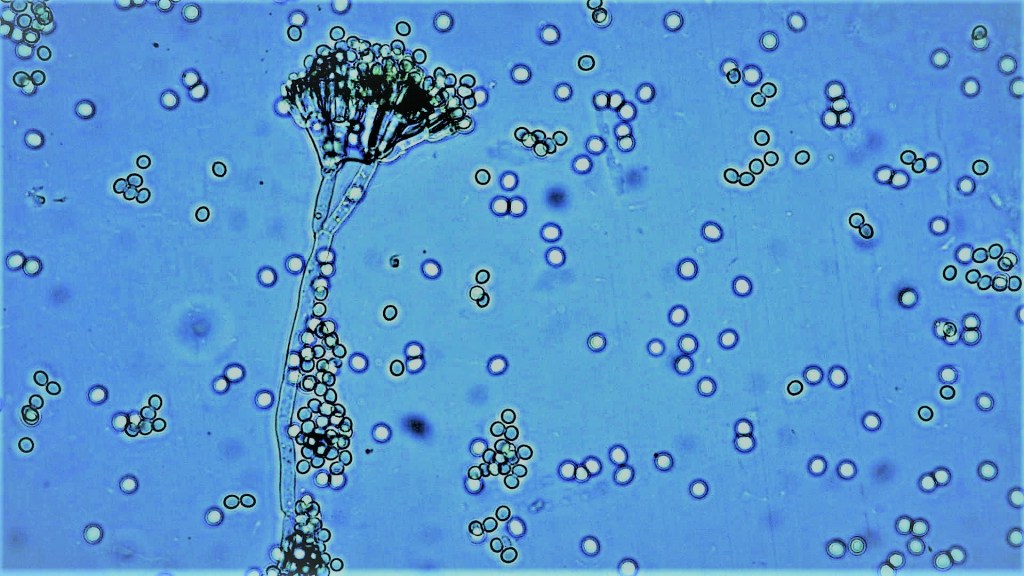

Biologicals have broad potential for effect. They can work to improve biotic resistance, abiotic stress tolerance, fertilizer use efficiency, general growth and more. There are trillions of different organisms living in the soil already affecting and regulating plants. Harnessing this wealth of microbial diversity and wide-range of influence has proven exceptionally beneficial so far. For instance, bradyrhizobium is a nitrogen-fixing bacteria used as an inoculant on 80% of soybean acres in Brazil and on increasing acres in the US and bacillus thuringiensis has been used commercially as a biopesticide for 30 years.

Research cost is also playing a role in the shift toward heightened focus on biologicals. As previously stated, agricultural R&D is benefitting from advancements in technology and understanding within the pharma and human biotech industries. There are significant research cost benefits to developing biologicals rather than synthetic inputs, which cost over USD200 mn and take 8-10 years to develop globally. Genetic modification of crop traits is a relatively new solution to agriculture, but GM development also has high research costs and products take even longer to get to market. These delays are coming from both lengthy development timelines and strict regulation requirements. Biostimulants have R&D costs of USD10 mn and a 4-6 year development time. Biopesticides are at USD25 mn and 5-6 years for the US market.

Biologicals such as naturally occurring microorganisms, cell extracts or other materials face lower regulatory hurdles. The Environmental Protection Agency does have a US registration procedure in place for biopesticides and biostimulants, but biofertilizers remain regulated on a state-by-state basis as are fertilizers. Compared with synthetics and GM solutions, biologicals face limited push back. Recent technological advancements in molecular biology, microbiology and genetics is leading to a revolutionary new type of biologics. These new biologicals are improved microbial species produced as a result of simple changes to target genes, a process known as gene editing. Enhanced biological products have previously been produced through traditional strain improvement platforms, however, these outdated processes are laborious, costly, and can result in off-target effects often taking years to achieve the desired effect. The newer method of gene editing allows for specific modifications to parts of the microbial genome resulting in a species that brings increased benefit to plants. Due to the relative ease in which the microbes can be produced, it is clear that the next wave of biologicals to reach the market will be gene edited microorganisms.

Investment

The biologicals market experienced a jump in growth rate in 2008. Many more small companies were responding to the need for innovation in the sustainable agriculture industry and grower perception of biologic products began to change to the positive as these smaller parties were backed by strategic alliances with major ag companies. The shift in thinking from biologics being reserved

for the niche organic market to biologics being effective in commercial agriculture transformed the industry. There was a rush of investment from large agricultural companies starting in 2012, initiated by Bayer CropScience’s acquisition of the leading microbial R&D company, AgraQuest. BASF, Syngenta, Monsanto (now part of Bayer), Novozymes and Chr. Hansen all followed with their own acquisitions or partnerships and more recently DuPont Pioneer and Koch have made moves into the biologics space. Hundreds of millions of dollars are being poured into researching these natural solutions.

Money also started coming in from venture firms in addition to the dominating players in the agricultural industry. According to Chemical & Engineering News, Cleantech Group reported that venture investment in agricultural technology grew from less than USD100 mn in 2012 to over USD250 mn in both 2013 and 2014, excluding investments in information technology and hardware firms.

Current market

The biological crop chemistry (biopesticides) industry is valued at approximately USD3.8 bn having grown at around 10% per annum in recent years. Biostimulants make up their own USD1.5 bn market and have been growing at around 15%. It is projected that these combined markets could surpass USD10 bn within a decade as the growth rates for both markets remain in double digits.

The biological crop chemistry industry is valued at approximately USD3.8 bn

There is now new research, new products and a new market sector developing for nitrogen fixing microbes for corn, wheat and other non-legume crops, which could well be double the size of the biopesticide and biostimulant markets. The NPK market is estimated to be worth around USD200 bn and fertilizers are one of the biggest costs for many row crop growers. Nitrogen fertilizer applications can be inefficient with losses to air, ground water and waterways. Therefore, there are strong drivers for the development and adoption of new technologies.

Historically the biologicals market was served by small and mid-tier entities but due to investment by major agricultural players, the current market is dominated by the same large companies as the rest of the industry. However, there are still many smaller companies working independently or alongside their larger competition and some exciting new startups with innovative R&D models and products.

Koch acquired Mendel Biotechnology at the end of 2014, which marked the start of the fertilizer giant’s work in biological research. At the beginning of 2016, the company added to their biological platform, acquiring a minority equity position in leader of biological plant health solutions, Pathway BioLogic. Pathway has already launched microbial products, some in combination with fertilizers, which should nicely complement the Mendel’s discovery platform.

There is huge potential to enhance plant breeding and improve traits

Mosaic and BioConsortia have recently announced a major collaboration to develop and launch nitrogen-fixing microbial products for corn, wheat and other non-legume row crops. Mosaic’s press release stated that the addition of robust nitrogen-fixing microbials uses the natural soil-plant process of nitrogen fixation, reducing the reliance on synthetic forms of nitrogen while still meeting the nutrient needs of the crop for its growth and development… and that the use of these products as part of a balanced crop nutrition plan can help farmers optimize the use of their fertilizer inputs and improve profitability.

Formulation developments

Some of the major challenges faced by everyone working with microbes are formulation, consistency

and compatibility with standard agronomic practices. Microbials have a history of poor consistency and this is a big turn-off for growers. Improved screening methods and developments in formulation are beginning to solve part of this problem. If the product contains microbes that easily colonize plants and if the formulation maintains survival, then it is more likely to have repeatable effects. That said, even if the sensitive microbe survives long enough to make it to the seed, it must then remain active and alive in the presence of any standard chemistries that will also be present. Biologicals are not completely replacing all synthetics at this point in time, so identifying treatments that are compatible with harsh chemistries is crucial.

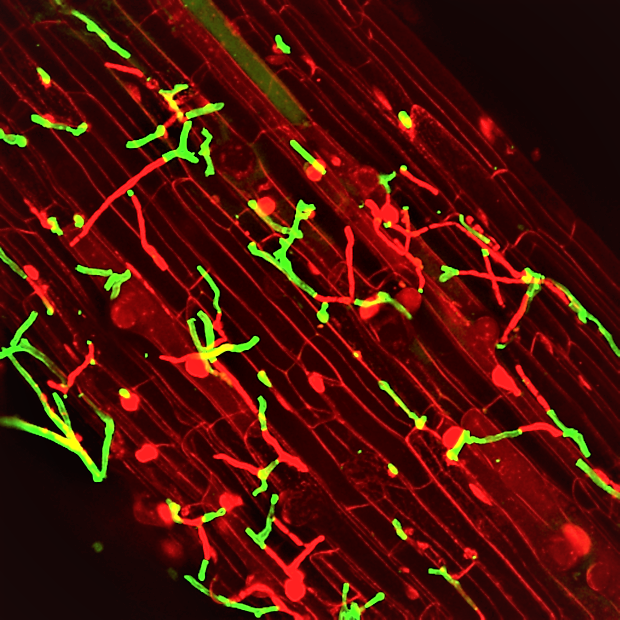

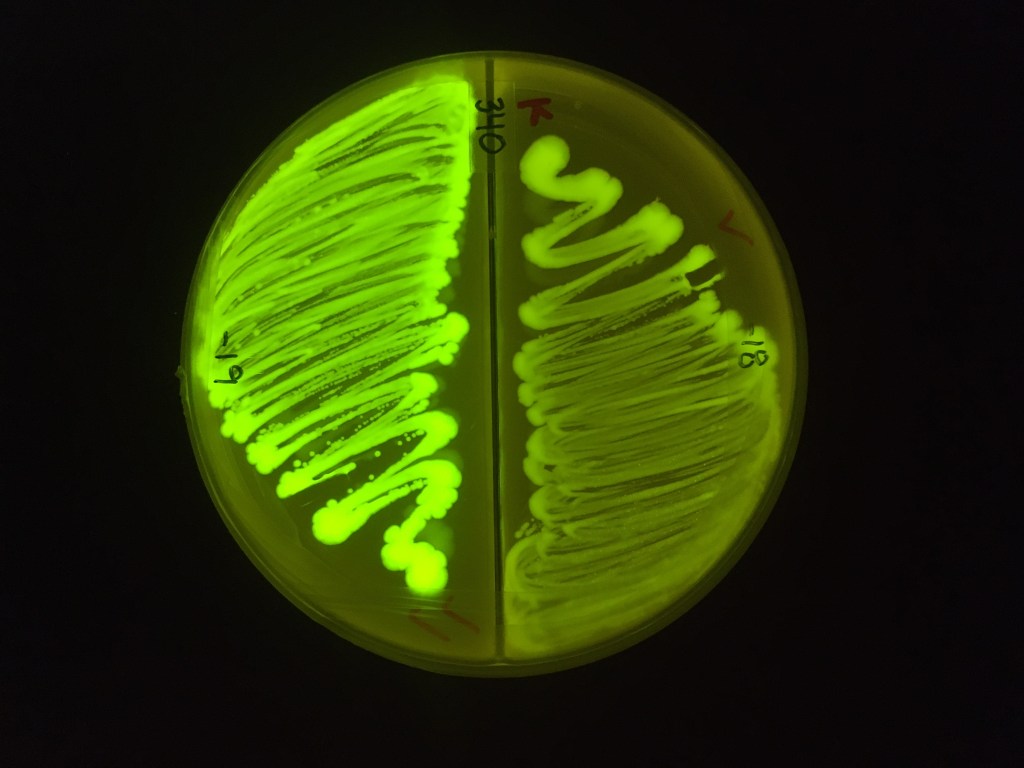

One key factor leading to a successful live microbial biostimulant is the ability to colonize plant surfaces. For colonization research, scientists can add fluorescent proteins to microbial genomes which are then produced by the cell. These now fluorescent cells can be visually observed on plants and stress-tested in numerous environmental, field-like conditions. A robust plant-colonizing microbe will continue to colonize plants throughout the growing season providing long-lasting benefit to the plant. To screen the collection of genetically diverse microorganisms for robust plant colonizers at BioConsortia a pipeline has been deployed to create a vast collection of fluorescently-tagged bacteria.

The Future

Continued technology advancements and investment in biologicals will drive significant improvements in product efficacy and consistency, discovery programmes, understanding of mode of action and formulation science. Research will likely further incorporate microbiome analysis and DNA sequencing to better our understanding of microbe-plant interactions. Given the technological progress there is huge potential to enhance plant breeding efforts and improve plant traits. Integrating biologicals with chemistries and traits will further bolster this potential, so developing microbial products that have compatibility with traditional practices should be a main target.

BioConsortia is using directed selection to discover microbial consortia products, or teams of microbes that perform complementary functions, with improved efficacy and consistency in the field. Nitrogen use efficiency is already in their pipeline, along with drought and cold tolerance, biotic resistance and general growth improvement. The company’s researchers are aiming to create gene-edited microbes capable of fixing atmospheric nitrogen to provide massive amounts of available nitrogen to plants thus offsetting the reliance solely on synthetic fertilizer. Not only will these biofertilizers coalesce with the changing environmental and regulatory landscape, BioConsortia’s biofertilizers will be compatible with traditional agricultural practices requiring minimal additional effort from growers.