Finding harmony within the chemistry–biology dichotomy

By Holly Meadows-Smith, Marketing Associate at BioConsortia

Holly Meadows-Smith, Marketing Associate at BioConsortia, explains the need for biologicals companies to work with the chemicals industry to develop compatible, synergistic solutions.

Biological Industry

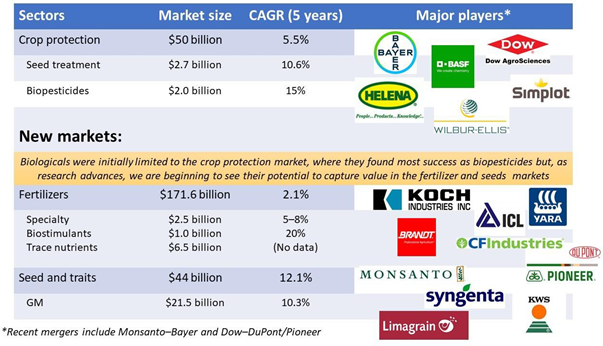

Estimated at over a $3 billion in 2016, by 2022 the biopesticide market is projected to reach $8.8 billion. Biostimulants are also growing in acceptance, with a particularly rapid CAGR through the same timeframe.

Growth in the biologicals market has been driven, at least in part, by consumer apprehensions toward the agrochemicals industry. The resulting focus-shift toward sustainability and environmental consciousness has been transforming agriculture for many years. Added to the fact that effective natural solutions may also provide a solution to chemical resistance issues, even the biggest players have incorporated natural, sustainable products into their product portfolios.

Within the agricultural bioscience investment arena, biologics are prioritized over new chemicals, genetics, and seeds. Inside the industry itself, almost all major agrochemicals companies have a hand in the biologics game, either through their own research spend or by procuring smaller biological companies. Major acquisitions and partnerships for biological companies include Bayer-AgraQuest, Monsanto-Novozymes, BASF-Becker Underwood, DuPont-Taxon, Syngenta-Pasteuria, FMC-Chr Hansen, and Koch-Mendel-Pathway. These alliances alone make for over $2 billion worth of direct investment into biological research programs.

Successful SME players include AgBiome, Koppert, Marrone Bioinnovations, and hundreds more. The biostimulant space (with solutions that range from plant growth promotion to improved fertilizer use efficiency to abiotic stress tolerance) is less saturated, although growing in size, and is made up of companies such as Agrinos, BioConsortia, Indigo, Verdesian, and Valagro. Many of these companies work in both areas.

New Technologies

Technological advancement is one contributor to the growing success of biologicals, enhancing both the breadth and scope of research programs through lowered cost and superior methodologies. Techniques like microbiome analysis have become common place in many research programs, and big data and machine learning have become buzzwords throughout the biological space. Companies like BioConsortia use ‘big’ microbiome data to help identify teams of microbes in superior performing plants, while Trace Genomicsdiagnose mutations and discover organisms based on genetic data that support the development of yield-relevant solutions.

CRISPR-Cas9, a ‘new’ gene-editing tool, has recently stepped into the agricultural limelight. CRISPR allows for gene activation, as well as natural gene addition/deletion, through precise mutation of existing DNA. Recently, Monsanto announced their license of the CRISPR-Cpf1 system, which offers even more flexibility to use the methodology across different crops and genes. The editing tool has already been incorporated into agricultural research.

Coexistence

The biologics industry still faces many challenges, largely relating to the expectations of growers who have become accustomed to the instant mortality of pests following the application of a synthetic pesticide, for example. In contrast, a microbial seed treatment for the same solution may have no effect on the pest but could induce a response in the plant that allows it to protect itself against the attack. Another challenge for natural solutions is consistency of efficacy. Historically, microbial solutions have been considered efficacious if they show yield effects 50% of the time. This is improving, of course, and will continue to do so as researchers better understand the mechanisms of biological effects. Formulation developments specific to microbial treatments will also ensure that biological products are delivered in an optimized form.

Nevertheless, most experts agree that the best strategy for biologicals is to work side-by-side with synthetic solutions. A natural treatment that can provide growth benefits under a reduced chemical fertilizer program, or a biological that brings benefit on top of a GM trait, are both viable routes to market and potentially more acceptable from a grower’s perspective.

On a practical level, a biological treatment is not likely to be applied commercially to a bare seed. Chemical seed treatments are so widely used that compatibility with harsh treatments should be considered at the initiation of biological research programs. For example, BioConsortia uses chemically treated seed throughout the discovery process in order to select for microbes that can survive in these conditions. Poncho/VOTiVOcombines natural and chemical solutions and the BioAg Alliance’s new Acceleron B-300 SAT does the same.

Biologicals have great potential to improve crop survival, growth, and yield while limiting negative impacts on the environment. By working within the current system and together with current solutions, biologicals have the potential to deliver the greatest success.