BioConsortia – A Lesson in Application, Innovation and Sound Science

Len Copping talks to Marcus Meadows-Smith, CEO of BioConsortia, about the company’s current position and its targets for increasing the value and understanding of biologicals in crop protection

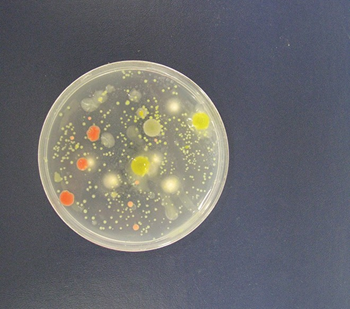

When Bayer CropScience bought AgraQuest in 2012 for $425 million, the CEO, Marcus Meadows-Smith, became Head of Biologics at Bayer. In 2014, he moved on to establish BioConsortia as the parent company to New Zealand based subsidiary, BioDiscovery Limited. BioDiscovery was founded in 1994. The company specializes in the discovery and development of natural microbial products, and over the past 20 years has developed the highest level of competency and expertise in ultra-high-throughput biological and bioactivity screening. They now hold one of the world’s largest collections of pre-screened (for plant association, having been isolated from high performing plants grown under a variety of biotic and abiotic stresses (Figure 1)) and characterized micro- organisms, comprising over 60,000 microbes, including 9,000 endophytes, the microbes that reside in plant tissues and most directly affect survival and growth.

In 2009, BioDiscovery made a breakthrough discovery in the conception of the Advanced Microbial Selection (AMS) patented process. Shortly afterwards, Khosla Ventures invested in the company as they focused on perfecting the innovative R&D platform. In 2014, the decision was made to globalize as BioConsortia, raising $15 million from Khosla Ventures and Otter Capital, and establishing the headquarters and laboratories in Davis, CA, USA.

BioConsortia identified the major barriers to the adoption of biological pesticides as – Poor efficacy; High cost; and Lack of information, knowledge, and trial results. At this time only 11% of farmers said that there was no barrier to stop them from using biopesticides and very few advisors recommended biological spray programmes. New, more effective biologicals were needed. The search for these new products using conventional methods is complicated by the complex plant-microbe interactions; the wealth of microbial genetics; microbe-microbe interactions; various crop cultivars and vari- able growing environments all of which add time to the selec- tion process and thereby increases the cost of discovery.

The solution developed by BioConsortia is Advanced Microbial Selection (AMS) which operates more like plant breeding with the microbiome evolving under selective pres- sure, across several generations, with the plants selecting the beneficial microbes. This directed iterative selection of the microbiome identifies teams of beneficial microbes. The subsequent selection is informed by conventional microbial techniques, as well as more recently using microbiome analysis and machine learning. Those plants which show the strongest reaction are selected and their microbiomes are analysed. This leads to colonization robustness, selection and optimisation of the fermentation process and of the formulation. Exposing plants to different stresses during the AMS selection rounds results in differential evolution of the microbiome. Seedlings accumulate a different microbial community structure than that present in the soil. OTUs (microbial species/strains – Operational Taxonomic Unit) in the soil are ranked by abundance and then compared to the OTUs associated with the plant’s rhizosphere, rhizoplane, endophytes and phylosphere. The most important microbes are not always the most abundant and AMS helps narrow in on the members of the microbiome that matter.

In its early days, BioConsortia’s mission was to discover new leads for other organisations to develop and register, but today the emphasis has changed. The company seeks to develop products with superior efficacy and higher consist- ency, demonstrate this in field conditions before involving third parties to do the Sales and Marketing. To enable this to take place, BioConsortia has raised $45 million in investment funding. It spends $10 million a year on R&D with a staff of 40 (eight in New Zealand) of whom 13 have PhDs.

These researchers are experts in microbiology, high-through- put screening, fermentation & formulation; microbiome and genomic analysis; and imaging and colonization understanding under stressed and unstressed conditions.

The targets of its research are products that improve harvestable yield and then to identify an appropriate distribution system.

It has a rich pipeline of leads for major row crops for intrinsic yield increase, water use efficiency, fertilizer use efficiency, fungicides and nematicides. It currently has six product candidates moving into the registration phase – 2 biofungicides and 4 biostimulants. The first biofungicide is a broad spectrum product for both foliar and soil diseases, which is expected to receive EPA clearance in 2021. Both biofungicides must be registered through the EPA whilst the biostimulants can be registered by state as they are not considered to be pesticides – a cheaper option. The biostimulants are undergoing state-wide registration at the moment. BioConsortia is just starting to introduce these products to potential partners for sales and marketing.

All of these product candidates are bacterially-based and can be used as seed treatments or as foliar sprays.

Clearly BioConsortia is moving forward using a specialist technique, innovative and imaginative research with a group of expert scientists. The future looks bright.